Pay Apps Are Revolutionizing Small Businesses

In the dynamic realm of commerce, change is the only constant. The digital revolution has ushered in transformative shifts, and small businesses are at the forefront of this evolution. The rise of pay apps is emerging as a pivotal force, revolutionizing the way small businesses handle transactions, interact with customers, and navigate the modern marketplace. This article delves into the intricate web of pay apps, their advantages for small businesses, and how they are reshaping the landscape of commerce.

The Rise of Pay Apps

As technology weaves its way into every facet of our lives, it’s no surprise that the way we pay for goods and services is also evolving. Pay apps have swiftly emerged as a game-changer, offering an array of benefits for both businesses and consumers.

The Emergence of Payment Applications

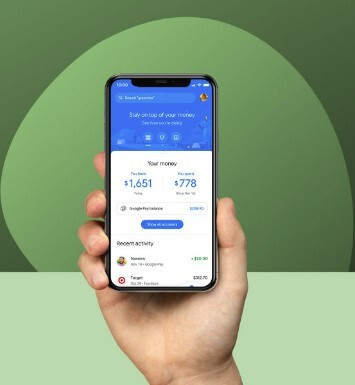

Pay apps, also known as mobile payment apps, have gained prominence for their ability to facilitate transactions through smartphones and other digital devices. From quick in-store payments to seamless online purchases, pay apps offer a versatile solution that aligns with the fast-paced nature of modern commerce.

Streamlined Transactions

Simplifying Payment Processes

Gone are the days of fumbling for cash or swiping cards. With pay apps, transactions have become streamlined and efficient. Customers can make payments with a simple tap or scan, eliminating the need for physical currency or cards. This simplicity not only enhances the customer experience but also accelerates the checkout process for small businesses.

Enhancing Customer Experiences

Customer experience is paramount in today’s competitive market. Pay apps contribute to a seamless and convenient shopping journey. Customers appreciate the ease of paying with their preferred app, and the frictionless process leaves a positive impression that encourages repeat business and fosters loyalty.

Small Businesses Embrace Change

Adapting to Digital Payment Trends

Small businesses are nimble by nature, and this agility extends to embracing digital payment trends. As pay apps gain traction, small businesses are quick to recognize the advantages they offer. From pop-up shops to local eateries, businesses of all sizes are integrating pay apps into their operations.

Overcoming Challenges

While the transition to pay apps offers undeniable benefits, it’s not without its challenges. Small business owners must navigate the learning curve, ensure compatibility with their existing systems, and address any concerns customers might have regarding security and privacy.

The Power of Convenience

Convenience as a Competitive Edge

In the world of commerce, convenience is a powerful currency. Pay apps provide a competitive edge by offering a level of convenience that resonates with modern consumers. The ability to make payments swiftly, securely, and without physical exchange positions small businesses as tech-savvy and customer-centric.

Meeting Customer Expectations

Customer expectations have evolved, driven by the rapid pace of technological advancements. Pay apps align with these expectations by providing a seamless payment experience that mirrors the digital interactions consumers have grown accustomed to in other aspects of their lives.

High Risk Lending vs. Pay Apps

A Comparison of Risk Factors

Traditional high risk lending and pay apps are two distinct approaches to financial transactions. While high risk lending involves potential credit risks for small businesses, pay apps focus on secure, direct payments. The latter eliminates intermediaries, reducing the risk of unpaid debts.

The Impact on Small Businesses

Pay apps offer a lifeline for small businesses, especially those that might face challenges accessing traditional lending options. Instead of taking on debt, small businesses can leverage pay apps to receive instant payments for products and services, improving cash flow and financial stability.

The Security Factor

Ensuring Secure Transactions

Security is a paramount concern when it comes to financial transactions. Pay apps address this concern by implementing robust encryption and security measures. Customers can make payments with confidence, knowing that their sensitive information is protected from unauthorized access.

Building Trust with Customers

Trust is the cornerstone of any successful business relationship. When customers feel confident in the security of their payment information, it fosters trust and strengthens the bond between businesses and their clientele. This trust is crucial for long-term customer loyalty and positive word-of-mouth referrals.

A New Era of Financial Literacy

Empowering Small Business Owners

The rise of pay apps ushers in a new era of financial literacy for small business owners. As these entrepreneurs integrate digital payment solutions, they become more adept at managing digital finances, tracking transactions, and leveraging data insights to make informed decisions.

Understanding Digital Finances

Pay apps encourage small business owners to delve into the world of digital finances. By gaining a deeper understanding of these platforms, business owners can explore how pay apps impact their revenue streams, customer preferences, and overall financial health.

Pay App Diversity

Exploring Different Pay App Options

One size does not fit all in the world of pay apps. Small businesses can choose from a diverse range of payment applications, each offering unique features and capabilities. Whether it’s a well-known app or a niche solution tailored to a specific industry, the options are plentiful.

Tailoring Solutions to Business Needs

The versatility of pay apps allows small businesses to tailor their payment solutions to their specific needs. Whether it’s offering subscriptions, loyalty programs, or integrated invoicing, businesses can leverage pay apps to enhance customer engagement and drive revenue.

The Future of Small Business Payments

Shaping the Payment Landscape

The emergence of pay apps is shaping the trajectory of small business payments. As more businesses integrate these solutions, they contribute to a shift in consumer behavior, encouraging a preference for digital transactions over traditional methods.

Evolving Trends

The future holds the promise of continued innovation in the payment space. From seamless integration with augmented reality to blockchain-based payment platforms, the evolution of pay apps is set to redefine the way small businesses and customers interact financially.

Conclusion

In an era defined by technological innovation, pay apps are not just tools; they are catalysts for change. Small businesses are embracing these applications as a means to streamline transactions, enhance customer experiences, and adapt to the demands of the modern marketplace. Pay apps empower small businesses to compete, thrive, and revolutionize the way they conduct business in a digital world.

As small businesses ride the wave of digital transformation, pay apps emerge as the tide that lifts all boats. They bridge gaps, foster growth, and ensure that small businesses remain relevant and resilient in an ever-evolving business landscape.

FAQs

- What are pay apps? Pay apps, or mobile payment apps, are digital platforms that allow users to make transactions using smartphones or other devices.

- How do pay apps benefit small businesses? Pay apps streamline transactions, enhance customer experiences, and offer convenience, positioning small businesses for success.

- What challenges do small businesses face when adopting pay apps? Small businesses may encounter challenges related to system integration, customer adoption, and security concerns.

- Are pay apps secure for financial transactions? Yes, pay apps prioritize security through encryption and other measures, ensuring safe transactions.

- What is the future of pay apps for small businesses? Pay apps will continue to evolve, shaping the payment landscape and driving digital transformation in small businesses.