The stress in traditional banking systems could indeed influence the interest rate path in the fintech lending sector.

This is due to a variety of reasons:

- Supply and Demand Dynamics: When traditional banks are under stress, they typically tighten their lending standards and reduce their lending volumes. This can lead to an increase in the demand for loans from alternative lenders, including fintech companies. If the demand exceeds the supply of available credit, fintech lenders may respond by increasing interest rates.

- Risk Assessment: Increased stress in the banking sector often signals broader economic instability. Fintech lenders might perceive this as increased credit risk, which could prompt them to increase interest rates to compensate for the heightened risk.

- Funding Costs: If bank stress results in higher interbank lending rates or makes it more difficult for fintech companies to raise capital, these increased funding costs may be passed on to borrowers in the form of higher interest rates.

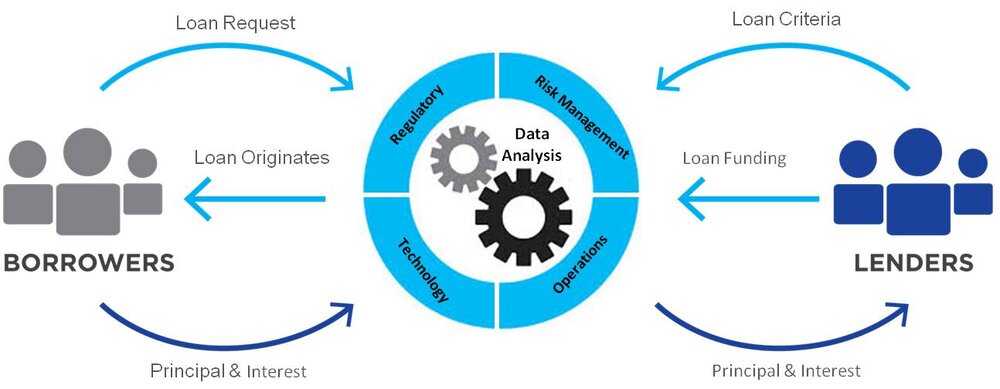

- Regulatory Environment: Depending on the regulatory response to banking sector stress, fintech companies may face new regulatory requirements that increase their costs. These additional costs could also contribute to higher interest rates.

However, it’s also worth noting that fintech lenders have some advantages that could help them mitigate these factors. Their reliance on technology and data-driven decision-making processes can lead to more efficient operations, which can help keep interest rates competitive. Furthermore, many fintech lenders have diversified funding sources, which may insulate them from shocks in the traditional banking sector.

In conclusion, while bank stress could influence the rate path in fintech lending, the actual impact will depend on a range of factors, including the specific characteristics of individual fintech lenders.